This paper focuses on supply chain issues in advanced manufacturing and related sectors including infrastructure and transportation, renewable and alternative energy, and battery applications.

(Download)

Executive Summary

The COVID-19 pandemic emphasized the importance of the United States industrial base, supply chains, and job training for the manufacturing workforce. Supply chain issues came to the fore with shortages of medical supplies and the need to quickly implement manufacturing capabilities for reshoring purposes.

Both the federal government and state and territorial governments have taken steps to strengthen U.S. supply chains. President Biden signed an Executive Order and requested industrial base reports from key federal agencies. Congress passed legislation targeting state and local needs during the pandemic. More recent legislation has focused on specific sectors, including infrastructure, transportation, renewable energy, and battery applications, and the manufacture of semiconductors with a variety of applications for national security and economic sectors.

State and territorial Governors are focused on implementing the new federal investments and requirements related to supply chains in infrastructure, semiconductor manufacturing, and renewable energy. While federal legislation has served as a significant driver of the investments, they are not the only drivers. Governors were already targeting several of these investment areas such as the production of electric vehicle batteries through traditional state-level economic development efforts and running into supply challenges even before the new federal investments. Governors are putting into place holistic approaches that help to better align their state and territorial initiatives, including in site development and workforce preparation with the new program models associated with the recent federal opportunities. They are working to address the impact of “Buy America” rules and domestic content guidelines on supply chains, along with other challenges they are facing.

Governors’ efforts through the National Governors Association (NGA) related to semiconductor and supply chain legislation started at the NGA 2022 Winter Meeting. Through the spring and summer summer of 2022, Governors leading NGA released statements of support as Congress deliberated. Following passage of the CHIPS and Science Act, the same NGA leadership applauded Congress in a statement on the same day. At NGA’s 2022 Winter Meeting, Governors also held a discussion with the U.S. Transportation Secretary on implementing the historic bipartisan Infrastructure Investment and Jobs Act, and they have advocated for infrastructure legislation dating back to the NGA Chairs’ Initiative on infrastructure beginning in 2019 and earlier.

What Is Included In This Brief

This paper focuses on supply chain issues in advanced manufacturing and related sectors including infrastructure and transportation, renewable and alternative energy, and battery applications. These sectors have been particularly affected by supply chain challenges – impacting, in turn, a large number of additional industries. Funding support for this brief is provided through NGA’s partnership with SSTI through the SSTI cooperative agreement with the National Institute of Standards & Technology.

Background

The current focus on supply chain issues in the U.S. is driven by a confluence of factors including the global COVID-19 pandemic and trade tensions with China. The COVID-19 pandemic highlighted the challenges of accessing critical goods like personal protective equipment (PPE) and medical instruments. In 2020, the National Governors Association (NGA) Legal Network examined these issues and provided guidance on PPE procurement, anti-price gouging measures, and state emergency actions. The pandemic also emphasized the importance of the industrial base, supply chains, and job training for the manufacturing workforce at the state level, and since then, both federal and state governments have taken steps to strengthen U.S. supply chains.

At the federal level, in early 2021, President Biden signed an Executive Order on America’s Supply Chains, accompanied by industrial base reports from seven federal agencies a year later. Congress has passed legislation targeting state and local government needs, including the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Coronavirus State and Local Fiscal Recovery Funds. More recent legislation has focused on specific sectors such as infrastructure and transportation, semiconductor manufacturing, and renewable and alternative energy.

States and territories have taken steps to lead, support and partner on implementation. For example, the CHIPS and Science Act encourages the development of domestic semiconductor supply chains, and the White House has identified locations for new investments in the U.S. centered around semiconductor facility locations, as well as other areas, including clean energy, electric vehicles (EVs) and batteries, and additional key sectors (Map 1).

The Infrastructure Investment and Jobs Act (IIJA) created new programs not only at the U.S. Department of Transportation, but also at the U.S. Department of Energy (DOE) and other cabinet-level departments. In their post-IIJA reorganization, DOE created an entire office focused on supply chains — the Office of Manufacturing and Energy Supply Chains. State Manufacturing Leadership is one of its programs, along with a handful of others supporting state investments, reflecting a renewed interest in strategies to reduce dependence on overseas suppliers.

In 2022, U.S. Commerce Secretary Gina Raimondo and Secretary of State Anthony Blinken hosted a Supply Chain Ministerial and Stakeholder Forum to foster cooperation with stakeholders and partner nations. At the North American Leaders’ Summit in 2023, the leaders of Mexico, the United States, and Canada committed to strengthening regional supply chains in industries like semiconductors and EVs.

Recent data indicates that supply chain conditions have generally improved since the pandemic, with delivery times returning to normal. However, certain sectors, such as semiconductors for vehicles, continue to face challenges. New supply chain issues have emerged with EVs, batteries, and alternative energy sources like solar and wind power. For example, regional coordination in offshore wind energy supply chains could create job opportunities across the U.S., as highlighted in the National Renewable Energy Laboratory’s 2023 roadmap.

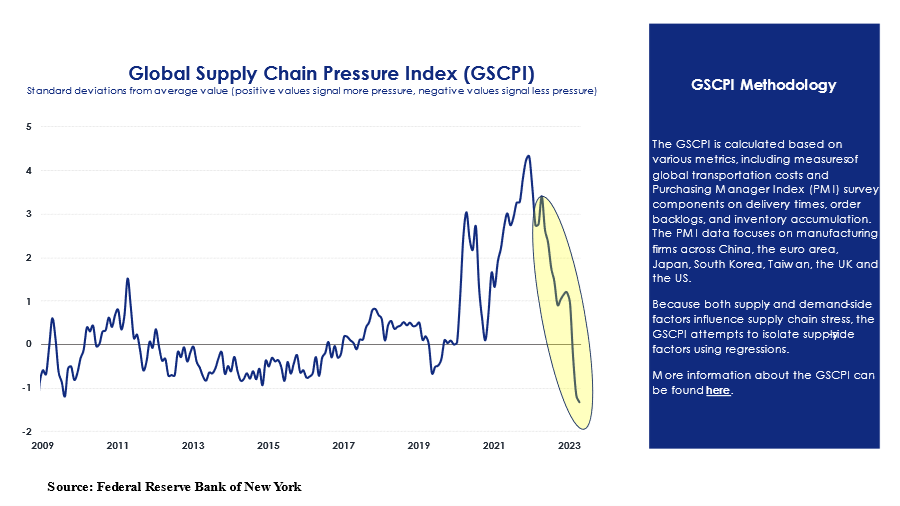

The Federal Reserve Bank of New York’s Global Supply Chain Pressure Index tracks global supply chain conditions based on transportation and manufacturing data. The latest data for 2022-2023 shows optimism, with faster supplier delivery times and declining shipping costs. However, these improvements coincide with a slowdown in economic activity, as evidenced by FedEx and UPS expecting declining sales in the industry in the coming quarters (Chart 1).

Governors’ Priorities

Governors are currently focusing on implementing federal investments in infrastructure, semiconductor manufacturing, and renewable energy. However, they face challenges in addressing issues of scale, complexity, and accountability with regard to site requirements and workforce needs impacting supply chains. As examples, a lack of workforce in a specific technical field can lead to delivery delays and poor quality – affecting the supply chain — and inadequately developed sites and insufficient infrastructure for manufacturing facilities can hinder the necessary expansion of suppliers — similarly affecting supply chains.

To maximize the benefits of federal funding, state and local leaders are exploring holistic approaches that align state initiatives with federal opportunities. This involves coordinating funding streams to ensure long-term financial sustainability and leveraging existing economic development projects and unfunded initiatives to enhance proposals and meet eligibility requirements for new federal funding. Additionally, Governors and states are also seeking information on methods of predicting future economic drivers and how those may impact new incentives; which critical products and sectors will be deemed “critical” in the event of a global crisis or future expansion; and the impact of “Buy America” rules and domestic content guidelines on supply chains. (T. Belcher, P. Readinger, K. Kudelko, personal communication, March 29, 2023.)

Infrastructure and Transportation Supply Chains

Supply chain issues in the infrastructure and transportation sector are primarily related to physical bottlenecks that hinder the movement of supplies on major transportation routes and distribution centers, including ports. The U.S. Department of Transportation’s Mega Grant Program, established by the IIJA, aims to alleviate long-term backups on highways, tunnels, and ports, thereby improving the movement of goods across the nation, and there are examples of recent successful improvements.

The state of Maryland‘s investments at the Port of Baltimore before the pandemic allowed it to avoid delays experienced by other ports across the U.S. Public-private partnership (P3) investments in infrastructure have driven growth at Maryland’s Port, while creating good-paying family-sustaining jobs in the process. These investments include the maintenance of the 50-foot channel, the deepening of two berths to 50 feet, and the installation of four new fully electric Neo-Panamax cranes capable of lifting 375 tons of cargo. Future investments in rail, including the Howard Street Tunnel expansion project, will allow for double-stacked containers to reach the Midwest, clearing a longtime hurdle for the Port of Baltimore and giving the East Coast seamless double-stack capacity from Maine to Florida. While not all states own, lease or operate ports, logistical bottlenecks in other modes of infrastructure and transportation must similarly be planned for and integrated.

Following the enactment of IIJA, Governors were asked to appoint an Infrastructure Coordinator to coordinate federal funding at the state level. Several states have established infrastructure offices to cover multiple policy areas. In Michigan, Governor Gretchen Whitmer created the Michigan Infrastructure Office (MIO) to execute her vision for infrastructure, coordinate with state and federal partners, and leverage resources to connect everyone. The state is also prioritizing workforce development to strengthen supply chains, especially for the semiconductor industry, which has faced critical shortages.

Michigan’s MIO and the Michigan Economic Development Corporation (MEDC) are focusing on the semiconductor industry, particularly for automotive vehicles. The state has formed a public-private partnership with a foreign semiconductor company, a technology innovation hub, the University of Michigan, Washtenaw Community College, and General Motors to establish a semiconductor center of excellence called the Semiconductor Talent & Automotive Research (STAR) initiative. The initiative aims to develop the semiconductor workforce and conduct research on EVs and autonomous vehicles. Michigan is also attracting the clean energy supply chain through a $200 million tax credit program that supports projects in renewable energy, industrial decarbonization, green hydrogen, and semiconductors, which has already attracted a new Ford battery plant. In response to recent passage of the state’s FY24 budget, Michigan’s Chief Infrastructure Officer Zach Kolodin said MIO looks forward to developing guidance for the administration of the new $337 million Make it in Michigan Competitiveness Fund to maximize the deployment of federal infrastructure, climate, and advanced manufacturing dollars.

Arizona has recently invested in transportation infrastructure, broadband, and a policy environment to accommodate its booming goods movement sector – particularly in the valley area west of Phoenix. The Arizona Commerce Authority, in collaboration with industry and stakeholders, has developed the National Semiconductor Economic Roadmap, bolstering the state’s strategic focus on semiconductor manufacturing. Arizona has positioned itself as a leader in semiconductor manufacturing with anchor investments of $20 billion from Intel and $40 billion from TSMC that have sparked over two dozen semiconductor expansions across the state’s economy since 2021. Like Michigan, Arizona has also made substantial commitments to workforce development for its semiconductor sector.

Electric Vehicle And EV Battery Supply Chains

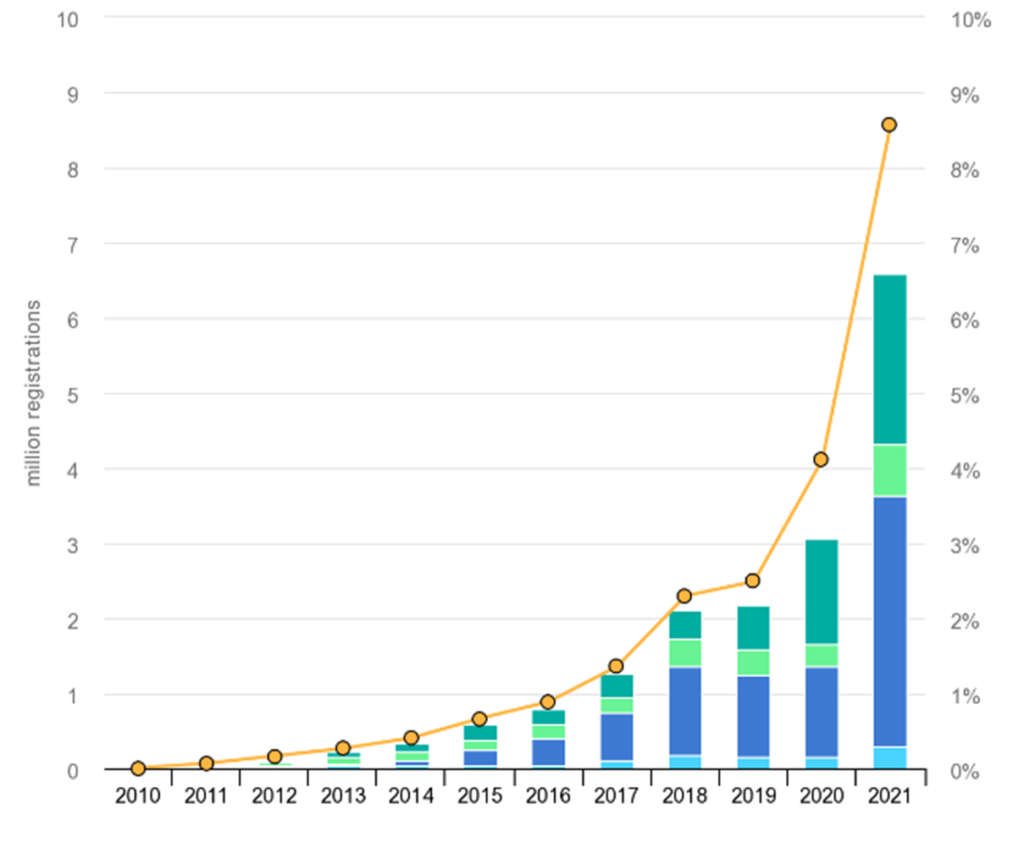

According to the U.S. Bureau of Economic Analysis, sales of passenger EVs in the U.S. jumped nearly 50% between 2021 and 2022, and a growing number of companies are signaling that they expect demand to continue to grow. Chart 2 shows the sharp increase in EV global sales during the decade leading up to 2021.

An issue inherent to the EV market is the lack of availability of certain critical minerals in the U.S. – particularly lithium for lithium-ion batteries used in EVs. The U.S. has less than 2% of the world’s lithium, and the only active lithium mine in the U.S. is in Nevada, with its processing done in China.

To address these challenges and promote domestic manufacturing, the Build America Buy America (BABA) Act was enacted as part of the IIJA. The BABA Act establishes a preference for domestically produced products and materials in infrastructure projects receiving federal financial assistance. It aims to increase reliance on domestic supply chains and boost American manufacturing. The Biden Administration is committed to implementing the BABA rules, but the final regulations and compliance guidelines are yet to be issued.

The BABA law also applies to projects covered by the Inflation Reduction Act (IRA), which focuses on increasing domestic supply chains for clean renewable energy. The IRA provides incentives for the purchase and use of American-made renewable energy products, such as a 30% tax credit for renewable energy facilities. Bonuses are also offered to companies establishing projects in disadvantaged communities. The U.S. Department of Transportation has temporarily waived the BABA requirements for products and materials used in EV chargers, with the intention of phasing out the waiver over time.

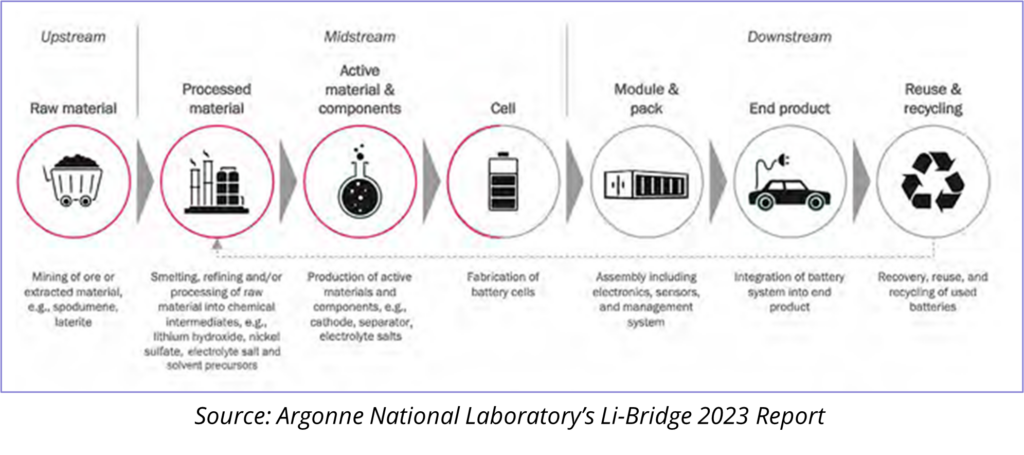

South Carolina has emerged as a major hub for EV and EV component manufacturing, particularly batteries. In 2022, Governor Henry McMaster launched an EV Economic Development Initiative via executive order to attract EV manufacturers, battery manufacturers, and companies involved in lithium production, and to enhance the EV workforce. The state has secured investments from various companies and is now attracting lithium providers for the EV market. The processes for producing batteries and other EV components can require many steps, which tend to be concentrated within a few countries and companies. Chart 3, below, depicts the US lithium battery supply chain, and the segments highlighted in red exhibit significant risk or gaps.

With sales of EVs increasing, the demand for lithium and other minerals has prompted the development of a relatively new industry to recycle used EV batteries. Another part of the supply chain that South Carolina is addressing is recycling lithium batteries by extracting lithium and other metals from old EV and hybrid vehicle batteries for recycling into new batteries. One plant, for which construction could begin next year, will also process lithium from its mines around the world, with plans to build a research center for processing that lithium at a close by location. Another producer of battery components for EVs resulted in the largest economic development announcement in South Carolina history, as a $3.5 billion investment will create 1,500 new jobs. The state has facilitated the development of these factories by cooperating with local governments, sharing funding for site development and infrastructure, and offering job development tax credits to EV battery companies.

It should be noted that to accommodate new investments in electrification projects — and energy generation and transmission via the grid, in general — a reliable supply of large power transformers is crucial. These are custom-made devices with 2 to 4-year lead times, and the US has only a handful of domestic manufacturers, as many still come from Asia. Recognizing this need, Governor McMaster also announced in June 2023 a related executive order creating a new energy planning and advisory group, the powerSC Energy Resources and Economic Development Interagency Working Group. In South Carolina and many other states and territories, there are major concerns about the need to modernize the electric grid in general and address the existing transformer shortage and future storm recovery issues specifically.

Solar Industry Supply Chains

The solar industry is considered a high-growth industry, with increasing demand driven by rising electricity costs and fossil fuel prices contrasted against the rapidly declining cost of solar panels. To promote domestic manufacturing in the solar industry, the IRA provides incentives for domestic manufacturers. However, it will take time for new solar manufacturers to establish themselves and meet the requirements for the federal tax credits, which are set to take full effect in 2024. Currently, only one U.S. company produces solar panels with enough domestic materials to qualify for the tax credits.

Solar power in a number of states has grown in recent years, even before the new federal incentives. Colorado established, early on, a renewable standard for its utilities requiring the increased production of energy from renewable sources over time. In addition to declining costs and new federal investments, statutory requirements for utilities to reduce GHG pollution at latest 80% below 2005 levels by 2030 has driven investment in solar generation. According to the Colorado 2022 clean jobs analysis from Environmental Entrepreneurs (E2), 8,157 people are now employed in solar jobs throughout the state. Colorado also has one of the most favorable net energy metering laws in the country, a billing mechanism that allows consumers who generate their own electricity to use it at times other than when generated. Consumers use solar power from rooftop solar panels, community solar gardens, and also from larger solar farms. Colorado has extensive academic programs devoted to education and research in solar power, along with a strong federal presence in the state including the National Renewable Energy Laboratory and major U.S. Department of Energy field offices.

Meanwhile, the solar industry continues to rely heavily on foreign supplies, with at least 80% of solar panels installed throughout the U.S. in 2021 being imported from Southeast Asian countries and China. Trade issues have impacted the solar industry due to China’s subsidization of its solar industry and concerns over forced labor in production lines. A 2022 investigation by the U.S. Commerce Department found that some Chinese solar manufacturers were circumventing duties by rerouting their imports for assembly in other Southeast Asian nations to avoid tariffs. The Commerce investigation created major uncertainty in the U.S. market, disrupted supply chains, jeopardized investments, halted solar installation projects, and posed a threat to jobs in the industry.

The Solar Energy Industries Association (SEIA) received complaints from numerous companies, and a bipartisan group of 19 Governors, including Colorado’s, wrote to the President seeking a resolution. In response, President Biden introduced a waiver to the domestic content preference, which has temporarily frozen solar tariffs for two years. And in early May 2023, the Treasury Department issued domestic content guidelines that help identify which solar panels qualify as “made in America” and are not affected by import tariffs, providing some clarity to the industry.

Manufacturing Supply Chains

According to the National Institute of Standards and Technology (NIST), manufacturing contributed $2.3 trillion to U.S. GDP in 2021, which was 12% of total U.S. GDP for the year. In addition, the manufacturing sector provides high-wage jobs and is a major source of technology and innovation. Two important trends are affecting the U.S. manufacturing sector: the trade issues noted above and rapidly evolving technological advances and related skills necessary to compete in this area.

Two well-established federal programs address various aspects of manufacturing sector growth and competitiveness: the Manufacturing Extension Partnership (MEP) program with a presence in every state and Puerto Rico, and the regionally-based Manufacturing USA Innovation Institutes. Each of these programs has a national network staffed by NIST at the U.S. Department of Commerce (DOC).

The MEP program provides business support to small and medium-sized enterprises (SMEs) within the manufacturing sector. Statewide MEP Centers in each state offer services such as supplier scouting, talent development, risk mitigation, and customized training. The centers work within the state ecosystem to help connect manufacturers with potential suppliers and facilitate interactions. MEP Centers also collaborate with state and local economic development organizations and trade groups to strengthen the manufacturing supply chain. Supplier scouting has helped MEP Centers identify areas where companies may need to upscale in terms of certifications or technology investments necessary to meet the expectations of potential supplier matches. The MEP Centers offer supply chain optimization services that involve examining shipping costs, inventory costs, and other costs; risk management which can involve a cybersecurity assessment; and value chain development, including distribution management and other considerations.

For every one dollar of federal investment in FY 2022, the MEP National Network generated $35.80 in new sales growth and $40.50 in new client investment. This translates into more than $5.6 billion in new sales.

Beginning in May 2023, the 51 MEP Centers are each receiving $400,000 through a 2-year cooperative agreement with NIST to address supply chain problems through enhanced supplier scouting activities. Authorized by Congress in 2023, this pilot program establishes an MEP National Supply Chain Optimization and Intelligence Network to address critical shortages and gaps in the U.S. supply chain. The funding is focusing on helping small and medium-sized businesses expand their manufacturing capabilities beyond their state’s traditional sectors. If a domestic supplier in a particular sector cannot be found, waivers will need to be issued to allow overseas sourcing. The aim of the supply chain optimization initiative is to reduce the number of waivers needing to be issued by finding domestic sources that might not be widely known, but are actually available. This National Supply Chain Optimization Network will run through May 2025, as the IRA’s domestic content production will take a couple of years to take effect.

Montana’s MEP Center

Jelt, a belt manufacturing company based in Montana, was working with a supplier in China, but purchasing and logistical challenges required the company to maintain high levels of inventory in order to meet unpredictable demand. The company’s owner reached out to the Montana Manufacturing Extension Center (MMEC) — the MEP Center affiliated with the National NetworkTM — for assistance with issues relating to quality control, performance standards, and contract negotiations. MMEC helped Jelt evaluate some U.S.-based manufacturing options, and provided customized training on negotiating with contract manufacturers and managing their performance. MMEC also introduced Jelt’s owner to the Montana Department of Corrections (DOC) which operates vocational programs for the state’s prison inmates, and the DOC has consistently met Jelt’s production, performance and delivery expectations.

Wyoming was one of the first states to sign its 2-year cooperative agreement with NIST. Wyoming’s MEP Center, called Manufacturing Works, will focus on helping to diversify business portfolios beyond the traditional Wyoming industries of mining and extraction of coal, oil, and gas. Wyoming Center director Rocky Case said, “If you have a manufacturer that is completely off the grid that no one knows about, but you have a major contractor that needs something they can make … We want to connect those unknown players with the known needs.” He added that Manufacturing Works will cooperate with neighboring states Colorado and Utah on this part of the cooperative agreement with NIST. GENEDGE, Virginia’s MEP Center, which is supported by the Commonwealth of Virginia as well as the national MEP program, is using its supply chain optimization funding to apply lessons learned from the aerospace and automotive industries to improve medical device quality. MEP staff will participate in a working group on best practices in supply chain resiliency and quality, and reach out to small and mid-sized manufacturers to join the new Intelligence Network.

“The United States needs to build a robust domestic manufacturing supply chain to ensure our critical infrastructure can be maintained and expanded. I am pleased that the federal government selected the University of Wyoming’s Manufacturing Works to identify gaps in and solutions to Wyoming’s manufacturing capabilities. As Wyoming continues to lead research, development, and demonstration projects for most energy sectors, it only makes sense we understand how Wyoming can also lead in fulfilling the manufacturing needs of these critical infrastructure sectors.”

Wyoming Governor Mark Gordon

The second federal program addressing manufacturing sector growth is Manufacturing USA, a relatively newer network of 16 Manufacturing Innovation Institutes across the nation that is coordinated by DOC/NIST. The Innovation Institutes, which are intended to help get technologies embedded into the manufacturing sector, are for use by public and private users nationwide. Members join the Institutes and gain access to each other, shared facilities, technology, equipment, intellectual property, and training and development opportunities. It is not out of the question for a state to attract a new federally funded Manufacturing USA Institute as, for example, new manufacturing innovation institutes will be funded by the Commerce Department’s Chips for America program at NIST. The existing institutes are funded by the U.S. Departments of Energy (DOE) and Defense (DOD), NASA, the National Science Foundation, NIST, and other federal departments and agencies, along with private sector and state-level investments.

Two examples of the Institutes that address smart manufacturing and digital manufacturing are the following:

- The Smart Manufacturing Institute at University of California-Los Angeles is known as “CESMII.” It is supported by DOE’s Office of Energy Efficiency & Renewable Energy. Although CESMII is headquartered in California, the Institute has team members spanning from southern California across to Pittsburgh, Pennsylvania.

- The Digital Manufacturing & Cybersecurity Institute, which helps manufacturers to digitize, is known as MxD (Manufacturing times Digital). MxD, located in Chicago, equips US factories with digital tools, cybersecurity, and related workforce expertise. This has enabled its 300+ partners to increase productivity, win more business, and strengthen U.S. manufacturing.

As reported in the most recent annual Manufacturing USA Report to Congress, in FY 2021 the 16 Institutes: worked with more than 2,000 member organizations and established 300 new memberships; managed 700+ applied R&D technology projects (a 33% increase); and engaged 85,000+ participants in workforce and training (a 25% increase), with a 30x increase in post-secondary teachers trained (from 29 to 960) and a 9x increase in certifications (from 757 to 7,161). State, federal, and private funds provided a $354 million investment beyond the $127 million in base federal funds, which was a 2.7:1 investment match.

Both the MEP program and the Manufacturing USA Institutes are focused on improving manufacturing competitiveness using different models that complement one another. While Manufacturing USA focuses on applied technology development and future manufacturing capabilities, the MEP Centers support SMEs in deploying available technologies and implementing successful business practices. Collaboration between the MEP Centers and Manufacturing USA Institutes allows manufacturers to benefit from the facilities, expertise, and connections provided by each network.

Supply Chains For The Defense Industrial Base

The defense industrial base sector involves research and development, and the production of weapons and systems for military use. In short, it enables the U.S. Defense Department’s operations and warfighting capabilities.

Washington offers an example of a state providing a place-based way to address manufacturing innovation for both defense and aerospace. These two related industry sectors rely on a well-functioning supply chain to thrive, and precision and safety are paramount. Recognizing this need, Washington has undertaken proactive measures to support the development of a strong supply chain through the establishment of an Aerospace & Defense Manufacturing Innovation Partnership Zone to encourage collaboration and innovation among industry stakeholders. This collaborative approach facilitates streamlined processes and knowledge-sharing within the supply chain.

Washington’s emphasis on local supply chain development also aligns with the principles of sustainability and resilience. By prioritizing the use of environmentally sustainable materials and practices, the state is ensuring that its aerospace and defense industries are contributing to a greener and more resilient future. In today’s rapidly evolving global marketplace, disruptions can arise from a variety of sources such as natural disasters or geopolitical issues. Washington’s efforts are minimizing vulnerabilities and enhancing the industry’s ability to withstand unforeseen challenges. Thus, this approach not only benefits the environment but also establishes the state as a frontrunner in the production and distribution of clean energy technologies. Through the promotion of collaboration, innovation, and sustainability, the state is proactively ensuring its competitive edge and long-term success.

North Dakota, despite ranking 44th among states in military procurement and contracting spending, addressed defense supply chain needs at the Air Force Base in Grand Forks. The University of North Dakota’s Center for Innovation received a grant from DOD to conduct a supply chain study. This study led to a statewide analysis of the state’s defense industry that helped foster a more engaged and collaborative regional defense ecosystem; the creation of an online industry supply chain portal; and a report to DOD that included recommendations to enhance the state’s role in national defense while contributing to economic development.

The Defense Manufacturing Community Support Program (DMCSP) is a federal-level program focused on place-based solutions for strengthening the defense industrial base by making long-term investments in facilities, R&D, skills development, small business support, and supply chain improvements. The program involves designating regional consortiums as “defense manufacturing communities” (DMCs) and providing funding to support their initiatives. These consortiums are often organized or led by state economic and workforce development programs; they may be university-based consortiums.

In 2020, the first year of the DMCSP program, six DMCs were designated and awarded funding in Alabama, California, Connecticut, Ohio, Pennsylvania, Utah, and West Virginia. These regions leveraged a total of $12.5 million in non-federal funds to support workforce and economic development initiatives, particularly in areas such as artificial intelligence (AI), 3D modeling, and advanced composites. In Mississippi, the DMCSP provided funding to the Mississippi Department of Employment Security to lead the Mississippi Shipbuilding Industry Preparedness for National Security Consortium. This project focused on modernizing the state’s shipbuilding industry, creating a diverse talent pipeline, adopting Industry 4.0 manufacturing practices, and enhancing worker safety.

The DMCs have strong connections to existing Manufacturing USA Innovation Institutes, which collaborate on applied R&D projects. The DOD Office of Local Defense Community Cooperation (OLDCC) convenes the network of DMCs and focuses on developing a national strategy to address the shortage of skilled manufacturing workers — similar to how NIST supports the national networks of MEP Centers and Manufacturing Innovation Institutes.

Holistic State Approaches To Addressing Manufacturing Supply Chain Issues

The importance of state and regional leadership for addressing supply chain issues cannot be overstated. The examples of Indiana and Connecticut illustrate holistic Governor-led strategies centered around state and regional partnerships to strengthen supply chains especially in their manufacturing sectors. Holistic approaches include mapping and understanding supply chain gaps, leveraging available funding opportunities and existing innovation and R&D programs, developing partnerships, enhancing workforce skills, and promoting supply chain resiliency.

Manufacturing is the largest industry sector in Indiana, accounting for 26% of the state’s economic output and employing more than 520,000. In 2017, Indiana Governor Eric Holcomb launched a multi-year innovation and entrepreneurship initiative seeded with $320 million and the positioning of an innovation officer at the Indiana Economic Development Corporation (IEDC). The IEDC played a crucial role in developing a vision and strategy for the state’s manufacturing sector, which focused on innovation and small business suppliers, Industry 4.0 for manufacturing, changing dynamics in strategic sectors, and mobility through autonomous vehicles and electric transit. Notable recent IEDC activities supporting those four focal points include:

- Launch of the Manufacturing Readiness Grants (MRG) program during the COVID-19 pandemic to stimulate private sector investments in modernizing the state’s manufacturing industry. The program made more than 400 awards totaling more than $40 million to support manufacturing technology and automation, including advanced robotics, additive manufacturing, and next-generation CNC machines. The MRG program has been successful in leveraging private sector investments, with combined budgets of over $500 million and more than a 10:1 leverage. During the state’s 2023 legislative session, the Indiana General Assembly supported Gov. Holcomb’s request for $40 million to continue the growth and support of this program over the next two years.

- Establishment of a public-private partnership with the Applied Research Institute (ARI) to identify key macro trends and administer the technology strategy for the state. ARI focuses on future technology areas such as hydrogen and hypersonic technologies, with advanced manufacturing and supply chain resiliency as strategic sub-sectors.

- Provision of funding to boost the Indiana Small Business Development Center’s Manufacturing Initiative to offer no-cost specialty advising through the Indiana-based Emerging Manufacturing Collaboration Center, known as EMC2.

Indiana-based manufacturing companies also benefit from resources such as the Purdue Manufacturing Extension Partnership (MEP) Center, which assists with supplier scouting and provides manufacturing skills training through programs such as its Manufacturing Skills for Success program, a 10-day bootcamp providing basic skills to fill immediate employer needs. The Purdue MEP Center collaborates with Conexus Indiana to understand and map supply chains, analyze workforce opportunities and needs, and identify gaps and disruptions. It also partners with state- and community-based organizations such as YMCAs and Goodwill to address common barriers to workforce success among prospective employees.

In Connecticut, Governor Ned Lamont appointed a Chief Manufacturing Officer (CMO) to lead the Connecticut Office of Manufacturing, which is situated in the state’s Department of Economic and Community Development. In March 2023, the CMO shared the Connecticut Manufacturing 2023 Strategic Plan with the Connecticut General Assembly’s Commerce Committee. The plan was developed in collaboration with about 200 manufacturing companies in the state. It focuses on three pillars: workforce, supply chain resiliency, and manufacturing industry expansion, with strategic initiatives and tactics outlined for each pillar. Around the same time in 2023, Gov. Lamont announced the launch of a free online platform called CONNEXTM Connecticut connecting manufacturers and suppliers. The program is funded through the state’s Manufacturing Innovation Fund and jointly managed by the Manufacturing Office and CONNSTEP, the state’s MEP Center.

Connecticut has leveraged federal defense funding through the Defense Department’s Office of Local Defense Community Cooperation (OLDCC). A portion of the state was designated as a Defense Manufacturing Community (DMC) in 2020, and funding was granted for a Digital Model Initiative (DMI), aimed at accelerating the adoption of 3D design and manufacturing technology in defense supply chains. The initiative involves collaboration between agencies such as the Connecticut Center for Advanced Technology (CCAT), CONNSTEP, and Central Connecticut University. CCAT leads the development of the technology, CONNSTEP manages the initiative and provides a Digital Transformation Guidebook, and the university offers credentials on model-based definition to implement the technology.

Conclusion

As the examples above illustrate, each state’s approach to addressing supply chain issues, including for the manufacturing sector, must be tailored to the unique aspects of the state or territory, especially its industrial assets. Connecticut’s approach involved understanding how its manufacturing companies engage with each other and other stakeholders, and how they are working to improve their efforts related to new technologies and available federal funding.

The new federal initiatives such as CHIPS, IRA and IIJA offer additional tools for the economic developer’s toolbox. States such as Arizona and Michigan are making them part of their strategies for regional ecosystems in a deliberate way to produce revitalized regional economies with competitive manufacturing sectors and high-quality, high-wage jobs. A holistic approach will help to identify resources from the available federal sources as well as help to develop a better understanding of the state’s manufacturing ecosystem.

As is apparent from the descriptions of several of the national networks, a community of practice has developed among the states and regions who are members of the networks. State support for and collaboration with these programs within states – especially the MEP program — helps to add sustainability and resiliency to state economies. This is being demonstrated in Wyoming and other states. Reshoring supply chains can involve a complex system of dozens of suppliers around the globe, and a product is not able to be produced if one supplier is backlogged. This reinforces the need for a focus on supply chain resiliency in all the sectors that are part of a supply chain. Sustainability and resilience are important so that any investments will last, as in the state of Washington. It is useful to focus on sustainable development from several angles, not just environmental and workforce sustainability for supply chains, but also the financial sustainability of the backbone organization supporting the regional ecosystem — whether it be an MEP Center, a Manufacturing Innovation Institute, a Defense Manufacturing Community consortium, or some other public-private partnership. Once the first major grant is received, it is important for ecosystem leaders to immediately start thinking about how to sustain the effort over time and evolve accordingly.

In terms of considerations on the horizon, Indiana stakeholders have noted that the pace at which manufacturing is evolving is astonishing (D. Watkins, D. Roberts, personal communication, March 29, 2023). A digital transformation is underway, and there is a need for state and territorial initiatives to move speedily to keep up the pace. IEDC staff also noted that many of the state’s manufacturers are small businesses who are feeling a boost from being written up in state reports on digital transformation in manufacturing and related topics. Indiana is helping its small firms to be more competitive through efficiency improvements and applying new technologies to be more productive as well as offering training bootcamps to address labor shortages. These are challenges even for large global companies, corporate headquarters, and original equipment manufacturers (OEMs) – much less small and medium-sized firms — as both talent and technology must be optimized concurrently.