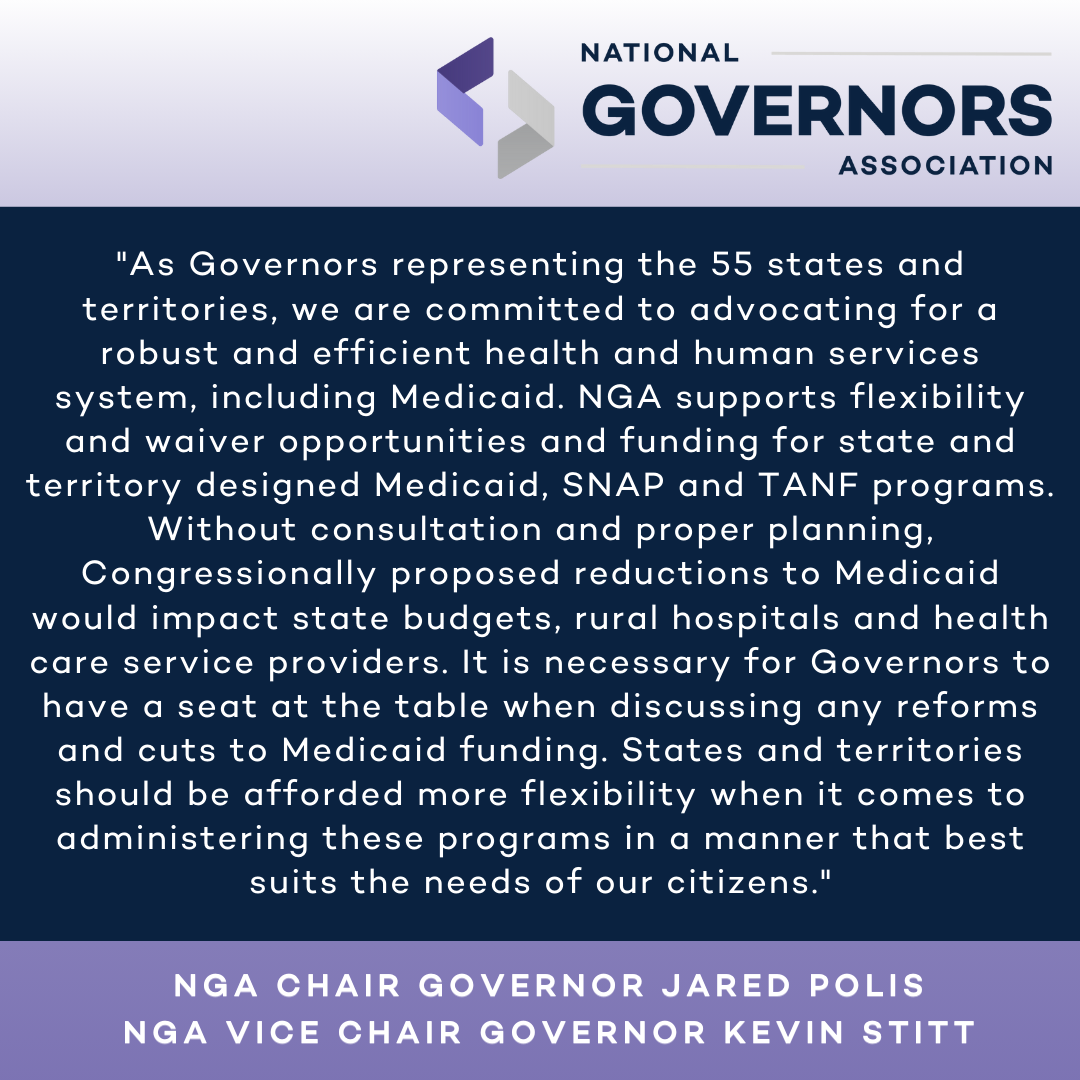

WASHINGTON – Today, National Governors Association Chair Governor Spencer Cox of Utah and Vice Chair Governor Jared Polis of Colorado released the following statement after the introduction and House committee markup of the Tax Relief for American Families and Workers Act of 2024.

“Governors on both sides of the aisle recognize the importance of advancing American innovation and competitiveness, ensuring that residents and businesses receive the necessary resources after disasters, and providing a sustainable path to housing options that are affordable.

“We were encouraged to see lawmakers introduce tax provisions to relieve double-taxation on activity between the United States and Taiwan, thereby accelerating semiconductor manufacturing in America and strengthening national security; allow expanded relief for individuals and companies impacted by disasters; and grant state housing finance agencies greater capacity to finance the construction or rehabilitation of affordable housing options for individuals and families through the low-income housing tax credit.

“As Congress considers a large tax package this year, Governors urge both chambers to move forward with these key bipartisan priorities and pass meaningful legislation as soon as possible to ensure certainty for the 2023 tax filing period.”